Bad Faith Claims

When the unexpected happens, we help individuals and businesses collect the money they deserve for their insurance claims.

We know that dealing with bad faith insurance claims can leave you feeling frustrated, confused, and powerless, especially when you're already dealing with a loss or hardship. Under Florida law, policyholders can file a Civil Remedy Notice if their insurance company acts in bad faith. When an insurance company fails to live up to its promises—whether by delaying your claim, denying it unfairly, or offering less than you're owed—it’s more than just a paperwork issue. It’s a violation of trust, and it’s a violation of your rights.

Who Needs Legal Help After Bad Faith Claim

- Policyholders with Denied Claims: If your insurance claim has been denied without a valid explanation or after an unreasonable delay, you may have grounds for a bad faith claim.

- Individuals Facing Low Settlement Offers: When your insurance company offers a settlement that seems unreasonably low compared to your damages, time to seek legal help.

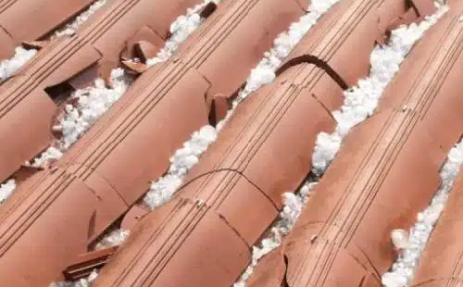

- Homeowners Dealing with Property Damage: For homeowners who have experienced property damage—whether from storms, fires, or other incidents—and find their claims mishandled or denied.

- Individuals with Health Insurance Issues: Those facing challenges with health insurance claims—such as denial of coverage for necessary treatments—may benefit from legal support.

- Business Owners with Commercial Claims: Business owners whose claims for property damage or liability are mishandled by their insurance company, or excessive delaying in the claiming process should consider consulting a lawyer.

What Challenges You Might Face Without Legal Assistance

- Without legal expertise, you might miss crucial details about coverage, exclusions, and obligations of insurance policy, leading to misunderstandings about what is covered in your claim.

- Insurance claims typically have a fixed timeframe. If you're unfamiliar with the claims process, you might miss this statute of limitations, resulting in a denied claim.

- Without knowledge of what evidence is needed, you may fail to provide adequate proof of damage.

- Insurance companies often have experienced adjusters who know how to minimize payouts. Without legal representation, you may struggle to negotiate effectively for a fair settlement.

- Accurately assessing smoke damage requires expertise, which is troublesome without legal help.

How Melamed Law Stands By Your Rights

- We help you understand the fine print of your insurance policy, ensuring you know exactly what’s covered and what’s not, avoiding costly misunderstandings.

- Our team ensures that your claim is filed within deadlines, so you don’t miss out on vital compensation due to procedural errors.

- We know exactly what evidence to collect and how to present it to make your case as strong as possible, ensuring your damages are properly documented.

- Insurance companies have experienced adjusters working to minimize your compensation. With us by your side, you’ll have an expert negotiator ensuring you get the fair compensation you deserve.

- We believe in fighting for your rights without the stress of upfront costs. You only pay us if we win your case, making the process as easy and risk-free as possible for you.

Let Melamed Law Lead the Way—

Contact Us for Trusted Guidance!